The homeowners association budget is a major responsibility for the board. Creating an accurate and well-thought-out budget ensures the financial health of your community — not just for the next fiscal year, but for many years to come. For new board members who are not yet familiar with this process, here are HOA budget guidelines that can prepare you for the task at hand.

What Is the Purpose of an HOA Budget?

An HOA is typically run like a business or corporation. Thus, it requires funds to ensure that the association is functioning properly.

The HOA operating budget ensures that there is enough money to pay for maintenance and repairs, landscaping, security, sewage, trash and recycling, management, and so on. These services are essential in maintaining homeowners’ quality of life.

Another vital purpose of HOA budgets is to ensure that there are enough reserve funds to pay for upcoming capital projects. New amenities increase property values and help attract new homebuyers to the community.

Reserve funds are also essential in case of emergencies. Without adequate reserves, the HOA may not have enough money to perform massive repairs following natural disasters such as floods, hurricanes, and typhoons.

Having an accurate budget also helps the HOA board make better, informed decisions on behalf of the association. Board members can be more responsible with spending the HOA’s funds and avoid overspending, which could lead to serious, long-lasting financial troubles for the community.

How to Prepare an HOA Annual Budget

If you are a new board member, HOA budget preparation can seem like a very daunting task. While it does take time to create a working HOA budget template for your community, consider following these steps to make the experience less stressful or demanding.

1. Assemble the HOA Budget Committee

One of the best strategies for creating an accurate annual budget is to start early. The HOA budget must be available on the first day of the upcoming fiscal year.

This means that the budget committee should start planning as early as five months before the deadline. You’ll have enough time to go through different financial documents to create an accurate budget for next year.

If you do not yet have a budget committee, assemble your team as early as possible. This allows you to delegate key responsibilities ahead of the planned budgeting session.

The team should include the board president and board treasurer. However, you can also include the HOA manager and homeowners who want to volunteer their time and financial expertise.

2. Prepare Financial Documents

Prepare all the financial documents that your committee will need for the annual budget. This includes monthly financial statements, the current reserve study, projected income statements, vendor contracts, utility bills, and the annual budget for the previous years.

Having these documents ready will allow the budget committee to work more efficiently. You don’t want to waste time rummaging through different file cabinets to find the documents you need.

3. Schedule a Budget Session

Coming up with an HOA budget is not something that you can do in a few minutes or even a couple of hours. Thus, budgeting should not just be an item in your regular board meeting agenda. You need to schedule an entire session dedicated to the annual budget.

Coming up with an HOA budget is not something that you can do in a few minutes or even a couple of hours. Thus, budgeting should not just be an item in your regular board meeting agenda. You need to schedule an entire session dedicated to the annual budget.

Find the most convenient time for your budget committee members. The budget session shouldn’t be held when they are tired or busy. That will just make the budgeting session even longer. You’re also prone to more mistakes if your committee members are distracted.

Allot enough time for the session — at least an entire day — so that the committee will not feel stressed. Include break times to give committee members a chance to refresh and regroup.

4. Create the HOA Annual Budget

Here are specific steps to follow when creating the HOA budget:

- Establish Financial Objectives: What does your HOA want to accomplish in the next fiscal year? How about the next 3 to 5 years? If the goal is to scale the HOA, you will have to budget for capital improvement projects. Meanwhile, if the goal is to ensure financial stability, the budget may focus on replenishing reserve funds. Establishing your financial objectives will influence how your annual budget will look like.

- Calculate Operating Expenses: Look at the day-to-day operations of the HOA to budget for essential expenses. What recurring services do the HOA have? You will have to calculate utilities, maintenance costs, insurance premiums, landscaping, security, management fees, and so on to come up with your operating budget.

- Check Vendor Contracts: Look at your active vendor contracts to see if there are scheduled price increases. Meanwhile, if you have expiring vendor contracts, you need to decide whether to renew the contract (and renegotiate prices) or to look for new vendors. If the latter, request for proposals ahead of time to ensure the accuracy of the budget.

- Calculate Estimated Revenue: How much does the HOA expect to earn in the coming fiscal year? Take a look at the HOA’s assessments, reserves, and investments. Are these enough to cover the operating expenses? If not, the budget committee may decide to raise monthly dues or levy a special assessment. Make sure to check your governing documents on how to proceed because these actions typically require a majority vote from the homeowners.

- Budget for the Unexpected: Padding the budget for unexpected expenses is a good financial move. It helps prepare the HOA for events that are out of anyone’s control. Just make sure to be specific when budgeting for these items to prevent financial errors or wrongdoings. You should also budget for inflation, bad debt or delinquencies, loan payments, and deferred payments.

5. Report Annual Budget to the HOA

After all the hard work comes more hard work. The budget committee will still need to present the annual budget to the board and the entire community.

The budget is typically presented during the HOA annual meeting in January or the start of the fiscal year. Make sure that the homeowners have access to the proposed annual budget and/or an easy-to-understand financial summary.

If there are pending decisions to be made — such as increasing dues or levying special assessments — the HOA may hold the vote during the annual meeting.

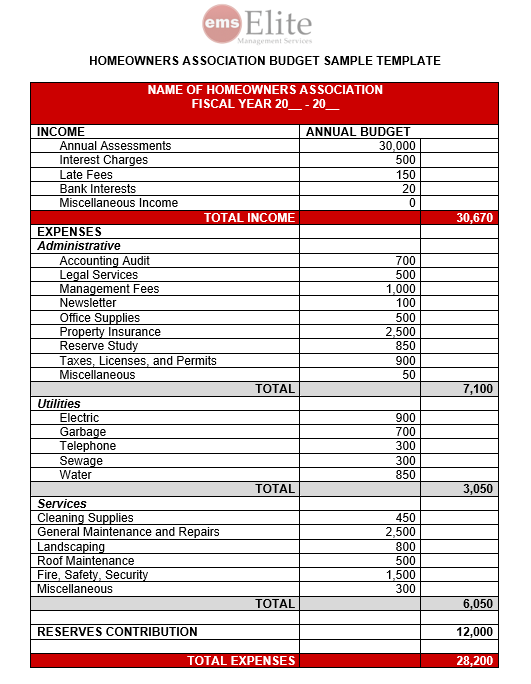

Homeowners Association Budget Sample Template

Here’s a free HOA budget example that you can use as a guide.

Click HERE to download the FREE HOA Budget Sample Template from EMS

Click HERE to download the FREE HOA Budget Sample Template from EMS

Follow HOA Budget Best Practices for Financial Security

Creating an HOA budget may not be easy but it is one of the major responsibilities of the HOA board. With strategic planning, your association can easily create an accurate annual budget that both reflects and protects the financial status of the association.

Just make sure to follow the steps and guidelines outlined above when creating an annual budget for your HOA. All your hard work will pay off when you see the community flourishing and homeowners’ enjoying their quality of life.

If you need help creating an HOA budget, feel free to reach out to Elite Management Services today! Email us at sales@emspm.com or contact us online to learn more about our HOA management services.

RELATED ARTICLES:

- Is Asking For HOA Special Assessments Allowed?

- HOA Year End Checklist: End The Year Successfully

- HOA Accounting Standards The Board Must Set Up